Owning a Used Car: How Much Can You Expect to Pay Each Month?

You got the new car! Now what?

If you are tempted to cut corners on the purchase of your next used vehicle to save money, you may want to reconsider. Even though you can often find deals to save money up front, it usually comes back to bite you.

Simply put, getting a good deal on a used car spans beyond the purchase price. You also must consider the little things that accompany the monthly payment such as insurance, gas, maintenance and repairs. This may seem like a lot to afford, but it doesn’t necessarily mean you won’t be able to afford the used car of your dreams.

The costs of owning your ride is decreasing as time goes on. On average, the monthly operating and ownership costs associated with owning a sedan is $739.67 (or $8,876 per year), according to a recent report released by AAA. Operating costs include gas, maintenance and tires whereas ownership costs include full-coverage insurance, license, registration, taxes, depreciation and finance charges.

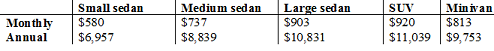

Here’s a detailed breakdown of their findings by vehicle type, based on a 15,000 annual mileage:

If you are blown away by these figures, don’t start worrying yet. Here are some things to consider when shopping that can help you save later on down the line:

Gas

Wouldn’t it be grand if all cars could run off of oxygen? Unfortunately, cars need gas, and gas is expensive. Even hybrids require gas to function. Bummer.

So, when you’re shopping, you’ll need to pay attention to the fuel economy ratings, both on the highway and in the city. Put this expense into your car budget, and see how often you can afford to fill your tank. Even though you can’t control gas prices, you can control how much you spend to fill up your tank each week.

Image via Energy.gov.

Maintenance

Extended warranties are great, but they typically only cover major repairs. That means you’re on your own with the day-to-day maintenance. It’s probably not a good idea to pick out the shiniest model on the lot without first taking a moment to figure out the anticipated maintenance costs. You can easily check some of these common costs with AutoMD’s repair calculator.

Generally speaking, the older the model and the higher the mileage, the more costly the maintenance. You also might want to get the maintenance records to see if the vehicle was properly cared for by its prior owner.

Tires

Don’t forget to take a peek at the tires. If they are extremely worn, they will need to be replaced, which can set you back hundreds of dollars out the gate.

Insurance

Besides the cost of the monthly payment, car insurance is a top expense for your car. Unfortunately, it’s illegal not to carry coverage if you live in any state except for New Hampshire, so insurance is an expense you can’t avoid. But, the year, make and model of your car can affect the cost of your insurance. If you need a little help deciding which vehicle is right for you, take a look at this year’s listing of the cheapest cars to insure from Forbes.

Depreciation

Unless you seriously intend to drive the vehicle until the wheels fall off, you’ll want to purchase something that holds value. Otherwise, be prepared to fork over the difference between the sales price and what you owe when you want to sell or trade it in for a new set of wheels. Don’t let bargains on the purchase price fool you. Before putting any money down, look at the current asking price compared to older models to gain some insight on depreciation. And, steer clear of rebuilt or salvaged vehicles if you intend to earn any equity in your vehicle.

Bottom line, there is more to owning a car than just the car payments. You need to set a budget that includes all of the costs so you can see what you can reasonably afford.

For more tips on owning a used car, subscribe to our newsletter:

I am not impressed with what I read. I tried the drive time website and was approved in moments for a large amount. I was not given any indication as to what the monthly amount would be on the total spending amount. Looking here it appears they would be more than happy to take every cent I have each month. This is not good for me nor the company.

Hi J – we definitely want to work with you to create an affordable plan and get you into a vehicle you want. Your total spending amount will depend on a few things, such as the cost of the vehicle you select and your down payment amount. If you have your approval on hand, definitely contact your local dealership and they’ll be able to give you more specific information based on your information.

Great Article. Thanks for the info. Does anyone know where I can find a blank “Bankruptcy Court Monthly Operating Report (MOR)” to fill out?

Is it possible to set up a monthly payment that i can afford to pay?

Hi Bri – I recommend giving our Bridgecrest customer service a call at 800-967-8526. They will be able to provide you with any and all options available to you for your payments. Thank you. – Tiffany | DriveTime Community Manager

Do you guys allow more than 60 months to pay on a car

Hello Chris,

Thank you for your interest in DriveTime! Regarding the amount of time we offer to pay off a vehicle, I would encourage you to reach out to Bridgecrest, our loan servicing provider, at (800)967-8526. A team member would be glad to answer all of your questions.

Respectfully,

Jodi-Customer Relations

Are your payments monthly, because the one in Jackson MS was making people pay every 2 weeks?

Hello,

Thank you for reaching out!

Please know that the payment frequency that is set at the time of sale is dependent upon each customers’ individual pay frequency listed on their proof of income, therefore it varies from customer to customer.

If you would like some more detailed insight into this matter, I would strongly recommend reaching out to one of our dealership.

Please feel free to utilize the link below if you would like to locate the nearest DriveTime dealership:

https://www.drivetime.com/dealership

Sincerely,

Jacob – Customer Relations