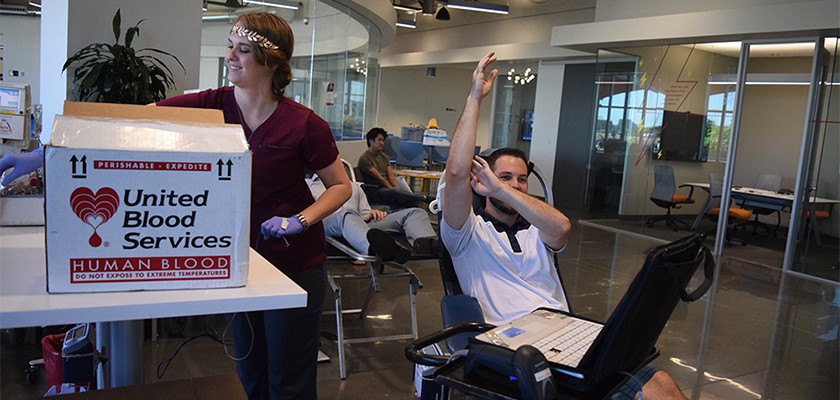

We Can Be Heroes: DriveTime Blood Drive

When you think of the term “blood thirsty,” you probably imagine vampires, zombies or any number of creepy things; but did you ever imagine it describing a place? United Blood Services would use it to describe the Phoenix valley, which at the moment is literally dying of thirst.

It’s estimated that the Phoenix valley alone needs 500 pints of blood a day to treat hospital patients, and United Blood Services are busy all day, every day, collecting blood to meet that daily deadline. Without their dedicated efforts, Phoenix hospitals wouldn’t be able to treat their surgery patients, conduct chemo therapy session or save accident victims. Continue reading…